St. Louis-based Monsanto aims to get a sneak peek at emerging agricultural technologies by boosting the company’s venture capital arm in 2013. The company signaled its investment-focused ramp up by hiring venture capitalist John Hamer in September who joined the company as investment director of Monsanto Growth Ventures.

Monsanto is soaring into the new year in a good position to invest in medium to large-sized biotechnology ventures. Just last week, Chairman Rep. Kingston, a Republican from Georgia on the House Agriculture Appropriations Subcommittee, attached a rider called the “Monsanto Protection Act” to the 2013 Agriculture Appropriations Bill (H.R. 5973) and the Farmers Assurance Provision (Section 733). If passed, Monsanto will be granted immunity when it comes to lawsuits and inquiries about their genetically modified agricultural products. The rider, if passed, will stop the USDA from regulating the use of genetically engineered organisms (GMOs).

If Monsanto is allowed by Congress to develop and distribute GMO agricultural products without USDA oversight, the company will be able to both invest in and acquire many new biotech firms that are working on novel GMO technologies without worrying about legal trouble.

John Hamer was formerly the managing director and general partner at Burrill & Company, a leading life sciences merchant bank, where he spent six years of his career and raised $500 million across three funds. He was the CEO of Paradigm Genetics Inc., an agricultural technology company IPO’ed in 2000 and later was acquired by Monsanto.

Since becoming the investment director of Monsanto Growth Ventures, Hamer has spoken at the Agri-Innovation Forum on an industry panel session “Meet the Corporate Strategics – Reinventing Everything: The Drive to Build the New Agricultural Bio Economy”. His role at Monsanto Growth Ventures will be invest in the creation of an innovation supply chain that includes emerging agritech companies, entrepreneurs, and researchers.

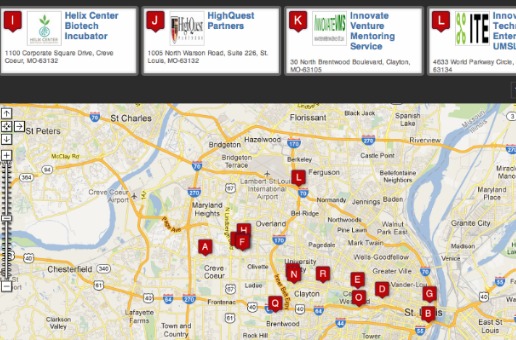

It’s likely that most of the investments that Hamer oversees will be in St. Louis companies. The St. Louis biotech industry is one of the largest biotech clusters in the nation with some of the world’s leading agricultural research centers.