Angel investment dollars used to mean asking friends and family members to invest in your budding business. These days however, angel investing has gone mainstream. More ‘regular’ folk are interested in jumping on the angel investing bandwagon. And for the most part, they are arms-length, high net worth individuals with disposable incomes, looking for a better (read: more profitable, albeit risky) place to park some of their investment dollars. Sites likes Angellist have even taken advantage of new federal laws allowing individuals to invest in syndicates alongside big name Angels and institutional investors in hot tech startups. The good news is that this equates to more opportunities to get ‘Angel’ dollars into your startup allowing you to reach the kind of milestones that might get VC’s excited. Or in another equally pleasant scenario, you might access Angel dollars to go on to build a highly successful business. Fundamentally, selling a piece of your company is akin to selling…well, pretty much anything. The first step is understanding your target audience, what they care about and why they should care about what you have to say. With that information in hand, you can tailor your pitch to resonate better with them, hopefully resulting in a check. Having said that, I have pitched to well over 60 Angels while raising half of the $2M that we have raised at Wagepoint. And, I started to notice a pattern in the types of Angels I came across. They shared common interests and reasons for why they liked the opportunity I was presenting. In the spirit of sharing my experience to give you a head start in identifying and convincing these good folk to invest in your company, here are the 3 types of Angels that I have pitched to during my time at Wagepoint:

Angel investment dollars used to mean asking friends and family members to invest in your budding business. These days however, angel investing has gone mainstream. More ‘regular’ folk are interested in jumping on the angel investing bandwagon. And for the most part, they are arms-length, high net worth individuals with disposable incomes, looking for a better (read: more profitable, albeit risky) place to park some of their investment dollars. Sites likes Angellist have even taken advantage of new federal laws allowing individuals to invest in syndicates alongside big name Angels and institutional investors in hot tech startups. The good news is that this equates to more opportunities to get ‘Angel’ dollars into your startup allowing you to reach the kind of milestones that might get VC’s excited. Or in another equally pleasant scenario, you might access Angel dollars to go on to build a highly successful business. Fundamentally, selling a piece of your company is akin to selling…well, pretty much anything. The first step is understanding your target audience, what they care about and why they should care about what you have to say. With that information in hand, you can tailor your pitch to resonate better with them, hopefully resulting in a check. Having said that, I have pitched to well over 60 Angels while raising half of the $2M that we have raised at Wagepoint. And, I started to notice a pattern in the types of Angels I came across. They shared common interests and reasons for why they liked the opportunity I was presenting. In the spirit of sharing my experience to give you a head start in identifying and convincing these good folk to invest in your company, here are the 3 types of Angels that I have pitched to during my time at Wagepoint:

The Believer

This type of Angel is all about the vision. He (or she) loves thinking big and is motivated by the ‘dream’. They typically have a higher risk tolerance and once they are in, they are truly committed. With other Angels, I have always seen some anxiety when the deal gets really serious and it comes time to write the check, but never with the Believer type of Angel. To land this type of Angel, you have to be able to paint the big picture, appeal to their emotional sensibilities while demonstrating your passion for the idea. With this Angel in particular, they are investing with their hearts and their minds. If you have not thought through the vision of your company, and if you are not able to articulate it simply enough, it might not be the right time to pitch this particular Angel.

The Builder

This Angel is motivated by the value they can bring to the table – the ‘execution’ element of the company is what excites them. Essentially, they want to build the company with you. They thrive in collaborative environments and are generally looking to coach you towards becoming successful. They might decide to invest and join you in operating the company, or at least be someone you can call on at anytime to discuss the weeds of the business. In most cases, this type of Angel likes the space you are in, has some deep domain knowledge and can see a clear path to helping you. They have a moderate risk tolerance and are doubling-down on their investment by staying involved. If you want to close this Angel, do your research and determine exactly how and why this Angel would be the right person to help you build the business together.

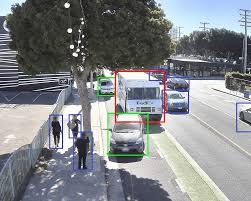

The Bean Counter

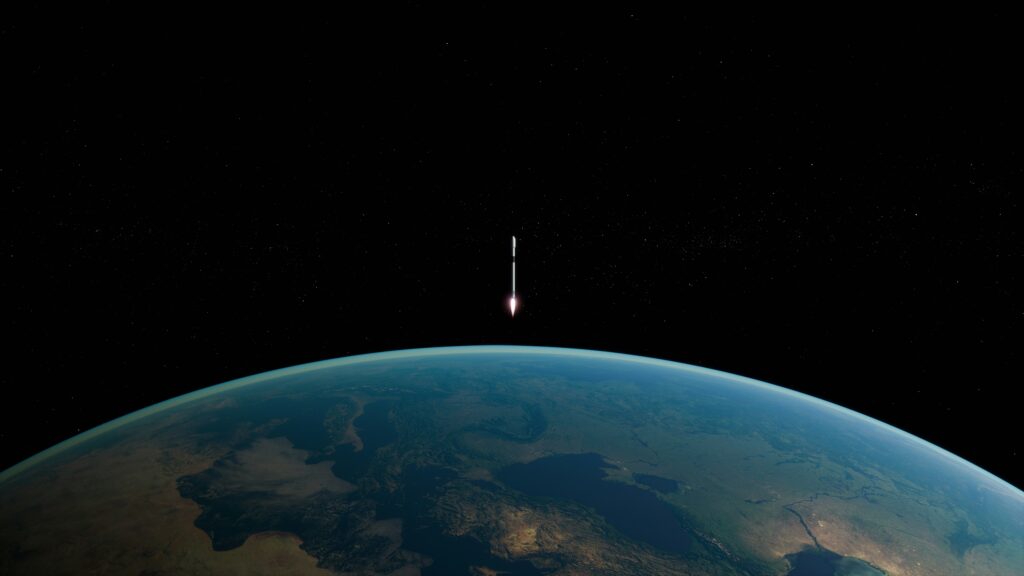

This type of Angel is motivated by the ‘math’. They like to see some traction in place so that they can extrapolate what the company might look like after their investment. They have a low risk tolerance, but the good news is that they know exactly what they are looking for so, they don’t waste a lot of your time. You either have it or you don’t. However, once they are convinced, this Angel moves quickly, so if you can focus on the details of ‘how’ you are going to grow the company, they are generally an easy sell. This means that if you are pre-product and generally pre-users, this Angel would not be a good fit. Those are the 3 types of Angels I have personally encountered during my travels. The question remains: which one is right for you? As with most things, it depends. For example, the Believer might be better at the earlier stages of your company when you don’t have anything but a bare-bones product and some product-market fit. The Builder might be better if you are looking for a partner to build the company with or if you are operating in a space that could use deep expertise. As for Wagepoint, we raised almost $1M from 3 angels – 2 of whom were Believers and 1 a Builder. And now that we have solid metrics in place, it might be time to find a Bean Counter. Hopefully, this helps frame Angel investing for any aspiring entrepreneur out there that may be looking for funding. If you have any other Angel profiles you can offer or experiences with Angel investors, share them in the comments. Keep reaching for the stars!