San Francisco Bay Area, home to Silicon Valley, is probably the first place that springs to mind when thinking about the West Coast tech scene in the US.

However, if you head just a few south to Los Angeles (LA), you’re likely to find a thriving tech scene of a different kind. Traditionally home to aspiring actors and screen writers, LA is increasingly welcoming entrepreneurs, tech gurus and investors across industries in the affectionately titled ‘Silicon Beach’.

In 2023, LA became the third-largest startup market in the US, with nearly 4,000 venture-backed startups based here. The city came in behind mega hubs in the San Francisco and New York, and ahead of other emerging tech hubs like Miami and Houston, highlighting its importance.

A recent report by ScienceDirect substantiated a direct correlation between the number of startups and the achievement of the UN SDGs (Sustainable Development Goals), with a link proven not only for economic, but also for social, environmental, and institutional SDGs, which increases the importance of startups for achieving sustainable development in economies.

The reality is, the area has been gaining momentum for a number of years. To give an example, even in 2016 Snap Inc. had already pulled in staggering $1.2 billion Series F funding round, while The Trade Desk, based in El Segundo, went public with a $1.1 billion valuation.

The tech community’s attraction to the area can be partly credited to its proximity to LAX and the diversity of the city’s myriad of industries.

The investor scene in Silicon Beach

In many cases, Los Angeles offers founders a really strong network of private investors. There’s also a large culture of entrepreneurship with accelerators and local events going on that help founders at all stages to make solid connections with potential partners and rising talent.

One notable fund in LA includes Pitbull Ventures, dedicated to backing exceptional founders across the US. The firm is a pre-seed vertical SaaS fund and has already invested in over 40 startups.

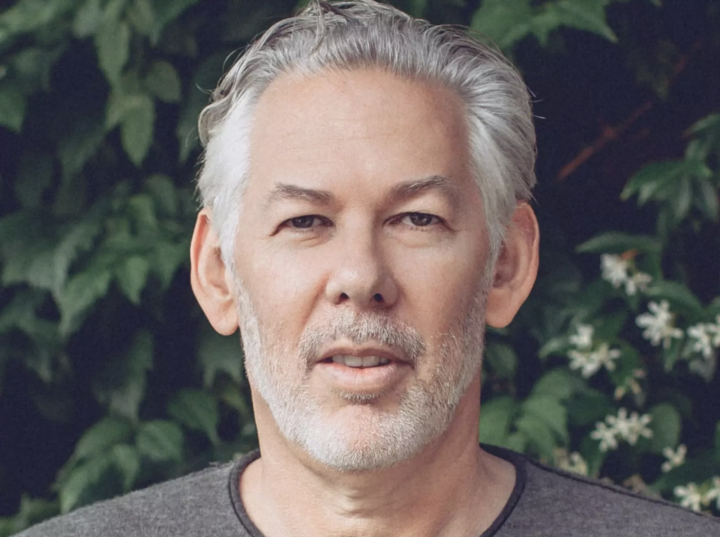

For Pitbull Ventures it really comes down to finding founders who have deep domain expertise in a particular vertical and who have signs of early product market fit. Managing Partner at Pitbull Ventures, Brad Zions, expanded: “I’m bullish on the sector because, although investor activity is quieter than in the past, the slower, more cautious pace means that the strongest founders and their new products have more space to rise to the surface.”

He continued, “There’s also more tech talent in the job market, along with new AI tools that make it easier to build an MVP with a bootstrapped software team. In short, 2024 is actually one of the best times for founders to launch a startup.”

Investor highlights in the area also include Fusion LA, a Santa Monica early-stage accelerator that provides nascent software startups from Israel’s booming tech scene an entree into the U.S. market.

Tech opportunities abound

The growth of any tech scene is dependent on attracting the right people to the area. Thanks to the countless co-working spaces and over 100 VC firms, LA has no trouble attracting a tech-savvy workforce.

In fact, over 1.5 million residents hold a bachelor’s degree or higher.

With opportunities ranging from startups operating within the Metaverse and fintech to crypto and gaming, it’s likely that the tech scene on Silicon Beach will only get stronger in the years ahead.

Featured photo of investor Brad Zions