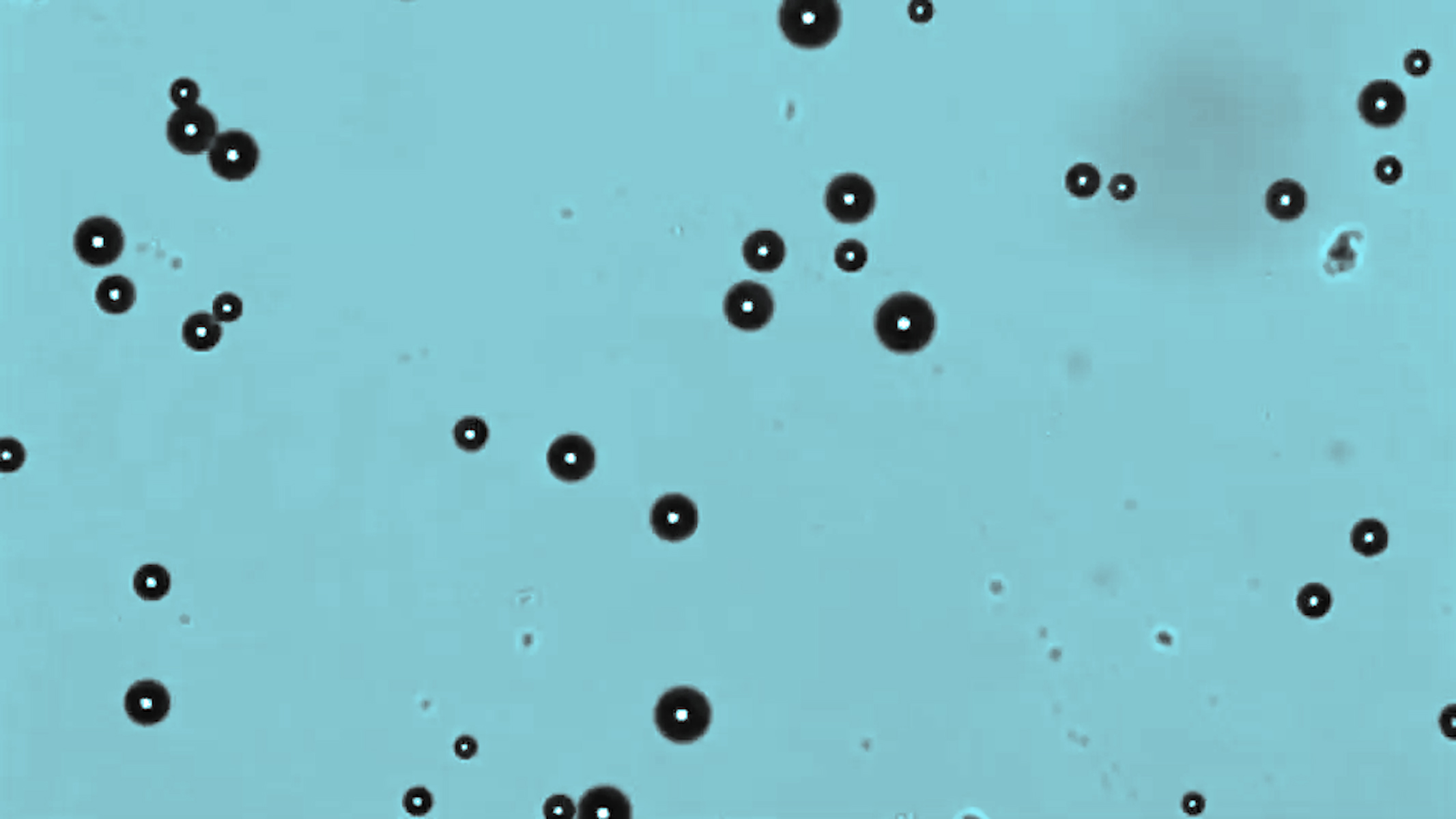

Ann Arbor-based Akadeum Life Sciences has secured $1.5 million in funding this month from venture capital firm BioInflexion Point Partners and other investors to continue innovating in the Midwestern medtech scene. Akadeum, founded in 2014, focuses on developing techniques for isolating cells, viruses and molecules, winning the CYTO Innovation Technology Showcase Award in August for its novel solutions. Cell isolation techniques so far are either not specific for a cell type, yield impure isolates, or use clunky methods with magnets. Akadeum’s flagship product tackles the problem using glass-shelled, gas-filled microbubbles. The unique approach enables cells or large biological molecules to be separated from tissues or cultures with high specificity, floating only targeted cells to the top where they can be easily picked up by scientists. Brock Siegel, managing partner at BioInflexion, said in a statement: “Our fund typically operates in the Bay Area, but the opportunity to invest in Akadeum Life Sciences—our first Michigan investment—is something we couldn’t overlook”. He explained that disruptive technology such as Akadeum’s is always a welcome addition to the fast-growing biotech field. Along with BioInflexion, the University of Michigan’s MINTS initiative, 5 Prime Ventures, Detroit Innovative Fund and eLab Ventures were among the teams that pitched, in a strong show of confidence in Akadeum across investors specialized in biotech and local startups. Isolating mammalian cells has been one of the basic steps for research in the biotech field for over 25 years. The company’s product line is currently limited to kits for isolating a few cell types, but with the new injection of funds they will be able to expand to more cells and biomolecules and find their way to diverse research labs the world over. With more startups popping up East and West of Michigan, particularly in Kalamazoo and Ann Arbor, this is great news for the state’s positioning as a startup center that has much to offer in the Midwest beyond Chicago.

Fizzy Ann Arbor biotech startup gets $1.5 million in funding

By Techli

22 septiembre, 2017