Are early stage startups hitting a cash crunch? That’s the word on the street and a recent article in Reuters by Bill Gurley of Benchmark Capital confirms this — backed by data from the National Venture Capital Association and ThomsonReuters. Last year, 777 companies raised $3.5 billion.

This year, $3.9 billion was raised amongst 859 companies in their initial rounds. VC firms themselves, including the big names like Benchmark, Accel Partners and Sequoia Capital, raised a total of $1.72 billion this year, compared to $3.5 billion in 2010. Even with new players in the field, like Michael Arrington’s CrunchFund, a growing number of promising startups might have difficulty raising funds.

Thomas Gatten, CEO of London based Startup Intelligence, thinks otherwise. Speaking to him on the phone after his visit to the Newcastle offices of the Ignite100 incubator, Gatten is confident this will be the “era of corporate sponsored innovation.” Anyone who has ever worked inside a large corporation knows innovation works at the speed a glacier might consider slow. Whereas startups are nimble, agile, indeed built for speed. Startups need money, especially if there are funding challenges on the horizon, and corporate profits will lack growth without continued innovation. Everyone benefits from innovation.

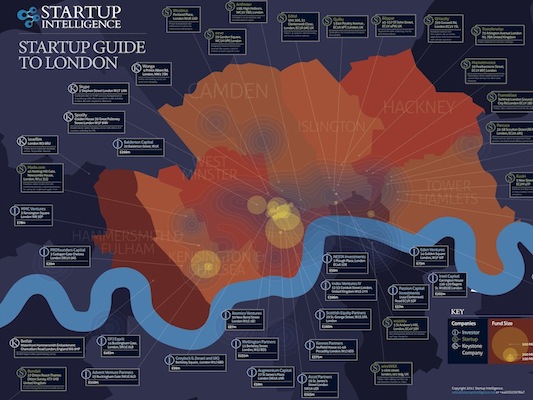

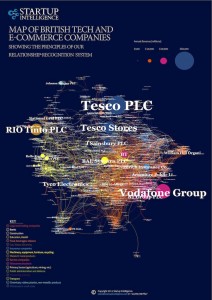

Gatten, an Oxford graduate and former journalist for the BBC World Service and Times of India, founded Startup Intelligence when he realized there was a lack of a real-time platform to track the growth of emerging tech startups globally. Startup Intelligence has created that platform. On October 27th, they launched their London Report at an event backed by IBM, Atomico Рa VC firm founded by Niklas Zennstr̦m, a co-founder of Skype; and the UK government department, UK Trade & Industry. At the event was Eric Van der Kleij, CEO of the Tech City Investment Organization, and Sherry Coutu, LinkedIn Board Member and Angel Investor. They are already generating revenue, producing bespoke reports for some respectable blue chip clients, and are preparing to roll out their platform world-wide in May 2012.

Some corporations, like Cisco Systems and BP, are currently investing in startup incubators, like the East London Tech City, alongside Google and Facebook. With this platform it is now possible to acquire data on thousands of early stage companies in real-time. The algorithms track how they could, or currently make money, and allows the client to analyze their sales process, product type, market type, their notoriety, and how they are leveraging the internet to grow.

Providing something which has never been possible before, and while it is not something the public will use, it could be very useful to blue chips looking to make sense of young innovative tech firms. I asked Gatten, what makes a startup viable? After a considered pause, he replied with, “focus on the money.”

If you are founding a startup, remember those words. Fulfill a market need, expect what you are doing to take longer and cost more, and don’t be put off by the often reported squeeze in VC funding. Those big blue chip corporations you might expect wouldn’t give you the time of day could suddenly have your back. That’s the new word on the street.

View Comments (0)