The difference between an employee and an entrepreneur is not the “Why didn’t I think of that?” heard around bar stools and coffee tables worldwide. It’s “Why didn’t I do that?” We all have million dollar ideas, entrepreneurs simply make them happen while everyone else waits for their palm to meet their forehead so they can exasperatedly proclaim that their golden opportunity was swiped away. As my father is fond of saying, “The opportunity of a lifetime comes by every day”. Take Shoefitr for example.

The difference between an employee and an entrepreneur is not the “Why didn’t I think of that?” heard around bar stools and coffee tables worldwide. It’s “Why didn’t I do that?” We all have million dollar ideas, entrepreneurs simply make them happen while everyone else waits for their palm to meet their forehead so they can exasperatedly proclaim that their golden opportunity was swiped away. As my father is fond of saying, “The opportunity of a lifetime comes by every day”. Take Shoefitr for example.

In 2006, two track stars at Carnegie Mellon (coincidentally my father’s Alma Mater), Breck Fresen and Nick End, realized they shared a common frustration with soccer team alumni Matt Wilkinson… and pretty much everyone else with feet. There was no way to determine how the size and model of the new athletic shoes they were interested in purchasing would fit unless they tried them on physically. However, the increased convenience, wider selection, and lower prices on sites like Zappos made shopping for sneakers online far more appealing. If only they could create a way to account for the lack of standardization in shoe sizing. It turns out the solution to this problem we’ve all fretted over at one time or another is remarkably simple; measure the dimensions of shoes and use your current pair as a baseline.

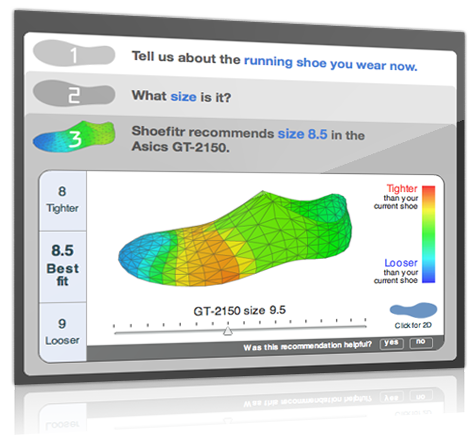

Shoefitr compares the measurements of the shoe you already own to the one you want to buy and recommends the correct size.

Why didn’t I think of that? Well, it helped that Wilkinson was an expert in 3D imaging, End an engineer, and Fresen a software wiz. Plus, they all had a passion for athletic gear. After a year collaborating remotely from three different cities to develop a working prototype, the three founders quit their full time jobs and moved into a shared apartment when the company was accepted to the Winter 2010 AlphaLab startup accelerator program.

Trading a 5% equity stake for $25,000 in seed capital, mentorship, connections, office space and everything else that comes with being a member of the illustrious TechStars Network, they actually started paying people to try on shoes and report the relative snugness of their toes (according to End, the most important part of quantifying shoe fit). After many hours tweaking their algorithm and manually scanning thousands of shoes into their proprietary system, they launched with major shoe e-tailer Running Warehouse and raised a few hundred thousand dollars in convertible notes while continuing to operate from the AlphaLabs facility well after the formal program had ended.

Sticking around paid off, helping make connections with all three investment groups – Innovation Works, Blue Tree Allied Angels, and Vital Financial – that would eventually contribute to their $1.2M round in October 2011. The terms of the deal are not disclosed, but the funds are being used to hire more engineers and subsidize the startup cost for new partners whose shoe inventory is not already scanned into their database.

Finding the right revenue model is still being fleshed out between licensing the technology at a flat rate, charging a small fee per acquisition, or a hybrid. But any way you slice it, they’re racking up new clients like Art’s Cyclery in the US and Rebel Sports abroad, with stealth pilot trials in the works at a shortlist of major online shoe retailers. The company is also gaining attention in the shoe review sections of Runner’s World and Running Time magazines by using their proprietary technology to compare a particular shoe’s fit with the industry average of comparable shoes in their database.

The creation of Shoefitr perfectly follows the script for success in growing a tech startup in 2011. Friends with complementary skills sets come together to solve a common problem. They develop a minimum viable product in their spare time and join prestigious incubator. Then they get a marquee client to pay for the service and raise stop-gap capital without giving up equity. Once prepared with proven technology and marketing metrics, they raise institutional capital to grow quickly.

If the goal is a high dollar exit, I’m sure the story ends fittingly.